Autonomous Vehicles Will Drive Automotive Sensor Market Growth, Finds IDTechEx Research

IDTechEx’s new report “Autonomous Cars, Robotaxis and Sensors 2024-2044” shows that autonomous cars are slowly, but very indeed, becoming a part of everyday life. Although they have been hyped and overpromised for a long time, the industry has accomplished some significant milestones in the last couple of years.

The US and China have a handful of cities allowing commercial robotaxi services from industry leaders such as Cruise, Waymo, Baidu, AutoX, and more. Europe, on the other hand, has been ploughing ahead with private autonomous vehicles.

First, the Mercedes S-Class was given SAE level 3 certification in Germany, meaning that for the first time, drivers could let the car drive for them in minimal conditions. BMW has also entered the mix, saying that it will certify the 7-series and i7 for level 3 use by the end of the year.

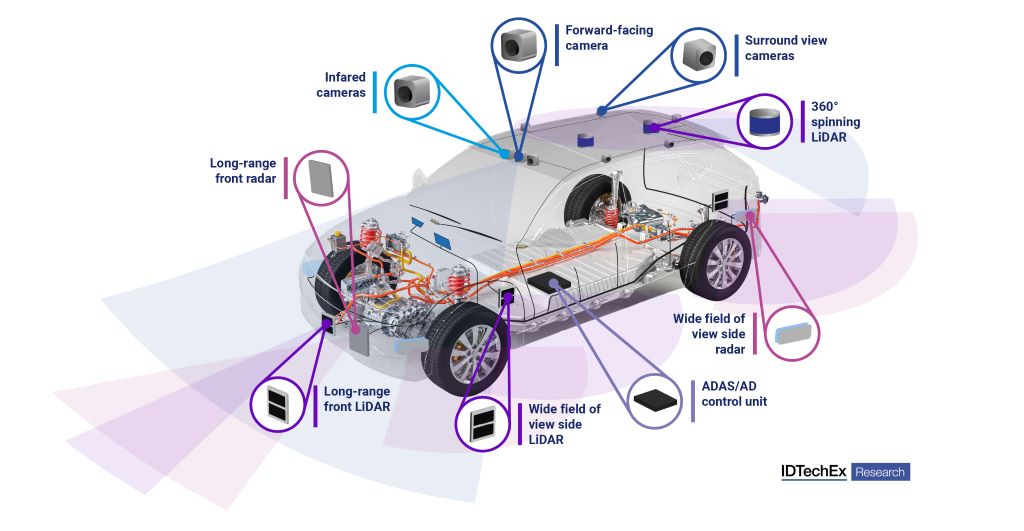

Whether it be a futuristic robotaxi shuffling you driverless-ly around a big city or a luxury limousine whisking you autonomously down the autobahn, there is one thing that all autonomous vehicles have in common – sensors, and usually lots of them.

Environmental sensors are not new to the automotive market. Cameras, radars, and ultrasonics have been used across the industry for decades now. So far, they have enabled advanced driver assistance systems (ADAS) such as adaptive cruise control and lane keep assist.

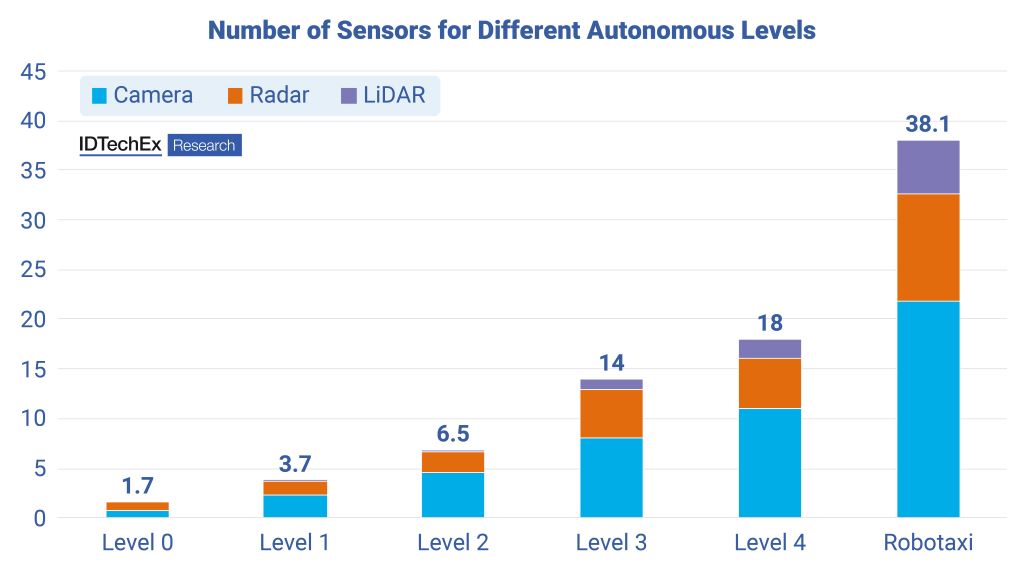

They have been used for safety features like parking sensors, reverse cameras, and automatic emergency braking. But these features can be enabled with very few sensors; typically, a single forward-facing radar and a couple of cameras can provide enough sensor coverage for a sophisticated SAE level 2 autonomous system. But at level 2, the driver is still responsible for the vehicle, whereas at level 3, the driver can start disengaging from the task.

Moving to SAE level 3 means entrusting the vehicle with more responsibility than ever. To do this, OEMs need the car to have the ability to monitor its surroundings thoroughly. As such, IDTechEx has seen through research for its “Autonomous Cars, Robotaxis & Sensors 2024-2044” report that level 3 requires significantly more environmental sensors than ever before.

Mercedes, for example, uses eight cameras, five radars, and one LiDAR on its ground baking level 3 drive pilot system. That’s 14 sensors required for autonomous driving, a big step from the few sensors typically seen on level 2 vehicles.

With level 2 vehicles only requiring a single forward-facing radar, level 3 creates a significant opportunity for the automotive radar market. However, some ADAS functionalities are coming to level 2 vehicles and below, which will also demand more radar.

Blind spot detection systems have existed for a long time but are still not widely deployed. IDTechEx’s report “Automotive Radar 2024-2044: Forecasts, Technologies, Applications” found that in 2022, approximately 30% of new vehicles were shipped with a blind spot detection system. That’s around 0.6 short-range, side-facing radars per vehicle on average.

Not only does level 3 provide a significant opportunity for the growth of the short-range radar market, but growth within ADAS deployment has the potential to increase the market by a factor of five!

This tremendous growth potential is possible as emerging safety features such as junction automatic emergency braking demand more radars than ever. Many in the industry predict that four radars per vehicle, used to provide a 360˚ monitoring cocoon, will become commonplace, driving enormous growth in the short-range radar market.

The front radar should not be neglected, though. IDTechEx’s report “Automotive Radar 2024-2044: Forecasts, Technologies, Applications” finds that 70% of new vehicles are shipped with a forward-facing radar.

IDTechEx expects that for most of the market, one radar for forward-facing applications such as adaptive cruise control will be sufficient, meaning there is limited remaining growth possible for this market before saturation.

However, that doesn’t immediately translate to limited opportunity. Radar has further untapped potential as a sensor for automotive applications. It is going through a massive technological evolution, with 4D imaging radars emerging and bringing generational performance improvements.

This seismic change in radar technology unlocks new performance and value for this sensor with a long-established presence in the automotive market.

In addition to the additional unit requirements of radar and cameras, level 3 vehicles are a beachhead market for LiDAR. LiDAR has been seen on vehicles before, and there are examples of vehicles that used LiDAR technologies in the early 2000s.

However, these were little more than one-dimensional range finders, and the technology has moved a long way since then. Modern LiDARs, such as the Valeo Scala used by Mercedes and the Innoviz system used by BMW, are sophisticated sensors vital for enabling autonomous driving.

LiDARs use narrow laser light beams, typically scanning across the scene to build a highly detailed 3D rendering of the vehicle’s surroundings. Unlike cameras, LiDAR provides highly accurate ranging information, and compared to radar, LiDAR has significantly better imaging abilities, making it able to classify pedestrians at great distances. The technology helps fill the performance gaps left by the camera and LiDAR, building a more complete and robust autonomous sensor suite.

For these reasons, LiDAR is a crucial sensor for enabling autonomous driving. The automotive LiDAR market is tiny, with only a handful of vehicles deploying this futuristic sensor.

However, the market will grow as autonomous technologies, like those from Mercedes and BMW, become more common. This will decrease prices and allow OEMs to include LiDAR on non-automated vehicles.

While LiDAR is a crucial sensor for enabling autonomous driving, it can also offer performance improvements to ADAS features that make it highly desirable for non-autonomous vehicles. One example is in automatic emergency braking systems.

One criticism of these systems so far has been their night-time performance. There is a measurable weakness with conventional cameras struggling in the darkness and radars not having sufficient imaging ability to identify pedestrians.

LiDAR can again fill this performance gap and offers the potential for significantly improved night-time performance of automatic emergency braking systems. More information about LiDAR, its deployment, and its forecasted growth can be found in IDTechEx’s LiDAR report – “LiDAR 2023-2033: Technologies, Players & Forecasts.”

Despite the automotive industry already having an established presence of cameras and radar on vehicles, there is still substantial room for growth. IDTechEx’s report “Autonomous Cars, Robotaxis and Sensors 2024-2044” predicts that the combined automotive camera, radar and LiDAR markets will see a 10-year CAGR of 13%, all of which is possible because of the emergence of autonomous technologies within cars.

UP IN NEWS

- Rolls-Royce Motor Cars Presents the Black Badge Ghost Ékleipsis Private Collection

- James Corden to Host RM Sotheby’s Auction During Las Vegas Grand Prix Weekend

- Tips for First-Time Pickup Truck Drivers

- Your Cold Could Leave You With a Nasty Fine This Autumn

- Nearly Half of Speed Cameras Inactive

For all the latest automotive news, reports, and reviews, follow us on Twitter, like us on Facebook, subscribe to our YouTube page, and follow us on Instagram, which is updated daily.

Stay Ahead of the Curve

Unlock the World’s Leading Source of Automotive News and Analysis.

Autoscommunity.com provides innovative marketing and advertising solutions to support an advertiser’s specific campaign objectives.

Customised programs leverage the best of Autoscommunity.com. Please contact our sales team today and see what our team can do for your custom advertising solutions.

-

Email: [email protected]

-

Please Read Our Privacy Policy

Why You Can Trust Autos Community

Our expert, award-winning staff selects the automotive-related news we cover and rigorously researches and tests our top picks.

Comments are closed.